I can help you conduct statistical analysis and reporting using EViews

- 4.6

- (5)

Project Details

Why Hire Me?

With 7+ years of experience in econometrics and applied statistics, I bring precision and clarity to your EViews-based analysis.

-

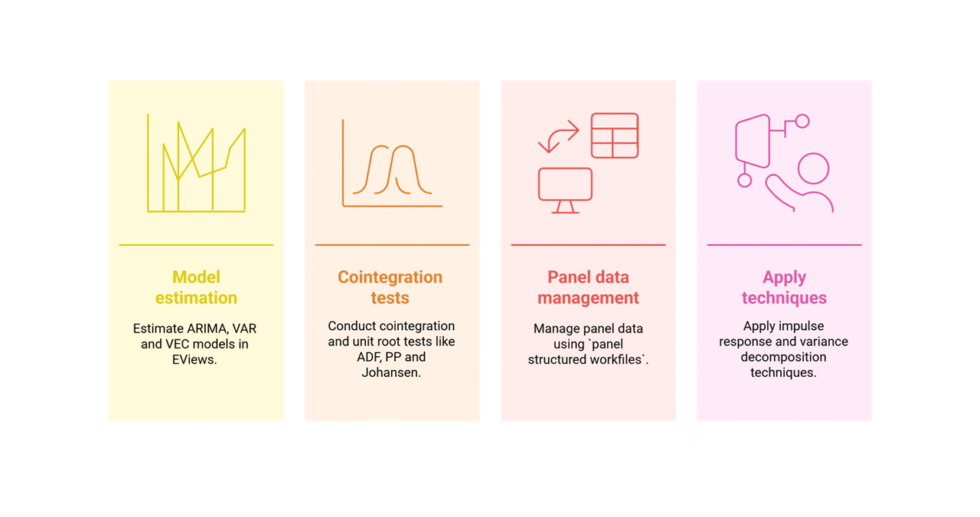

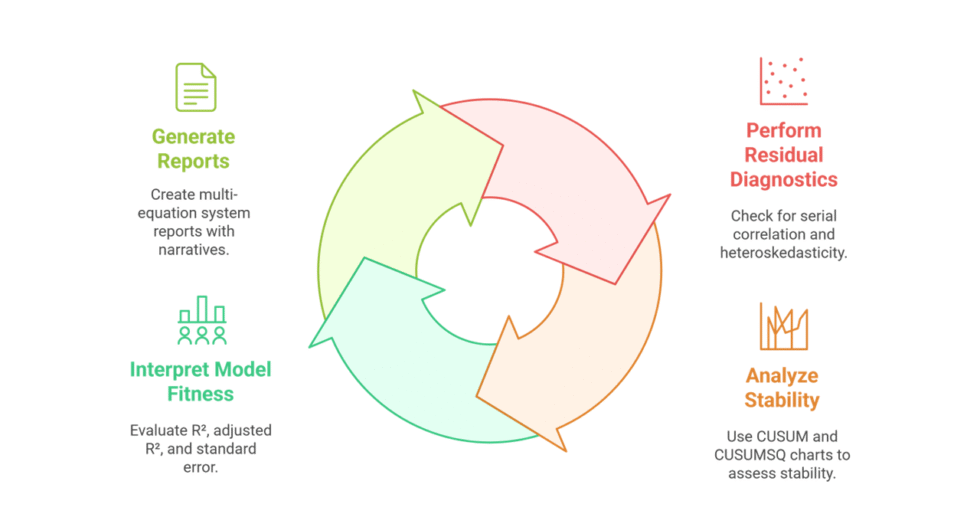

Specialized in time-series models, panel data analysis, cointegration, and forecasting

-

Proficient in ARIMA, VAR, VECM, GARCH, and other advanced econometric models

-

Skilled in translating raw statistical outputs into intuitive, decision-supporting reports

-

Adept at handling both academic and industry-specific economic and financial data

-

Committed to providing reproducible, well-documented code and interpretation

What I Need to Start Your Work

-

Project Details

-

Full overview of your study or analysis goals

-

Key research questions or econometric hypotheses

-

Context: e.g., academic thesis, policy research, or corporate forecast

-

-

Data and Data Description

-

Dataset(s) in

.prn,.csv, or Excel formats -

Variable descriptions, units, time frames, and any data transformations already applied

-

-

Analysis Scope

-

Preferred econometric techniques (e.g., stationarity testing, ARDL, VAR)

-

Specific EViews commands or estimators to include (if any)

-

-

Reporting Requirements

-

Desired structure of the final output (e.g., technical report, executive summary, or academic paper)

-

Graphs, charts, and formatted tables from EViews, as per need

-

Any formatting guidelines required for publication or presentation

-

-

Communication and Delivery

-

Preferred communication method (email, call, etc.)

-

Deadlines, key milestones, or phased deliveries

-

Portfolio

Analyzed Exchange Rate Impact on Inflation Using EViews VAR Model

Conducted a Vector Auto Regression (VAR) analysis in EViews to evaluate the pass-through effect of exchange rate movements on domestic inflation in a G7 economy. Findings informed macroeconomic forecasting.

Explored Housing Market Sensitivity to Interest Rates with EViews Cointegration

Used EViews to test for long-run equilibrium and short-run dynamics between interest rates and housing prices in the UK, employing Johansen cointegration and VECM techniques.

Modeled Corporate Investment Sensitivity to Economic Uncertainty in EViews

Developed a time-series regression model in EViews to quantify the relationship between corporate investment and a leading U.S. economic uncertainty index, delivering insights for strategic planning.

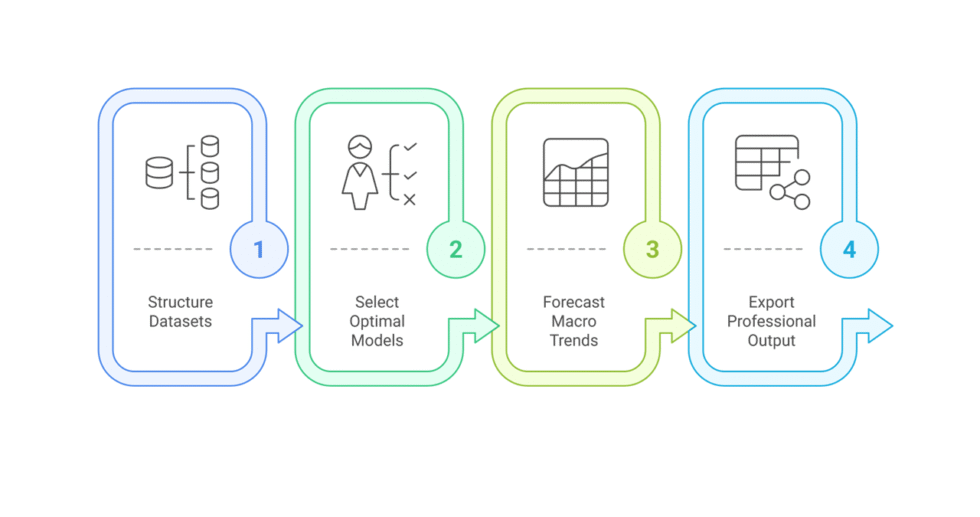

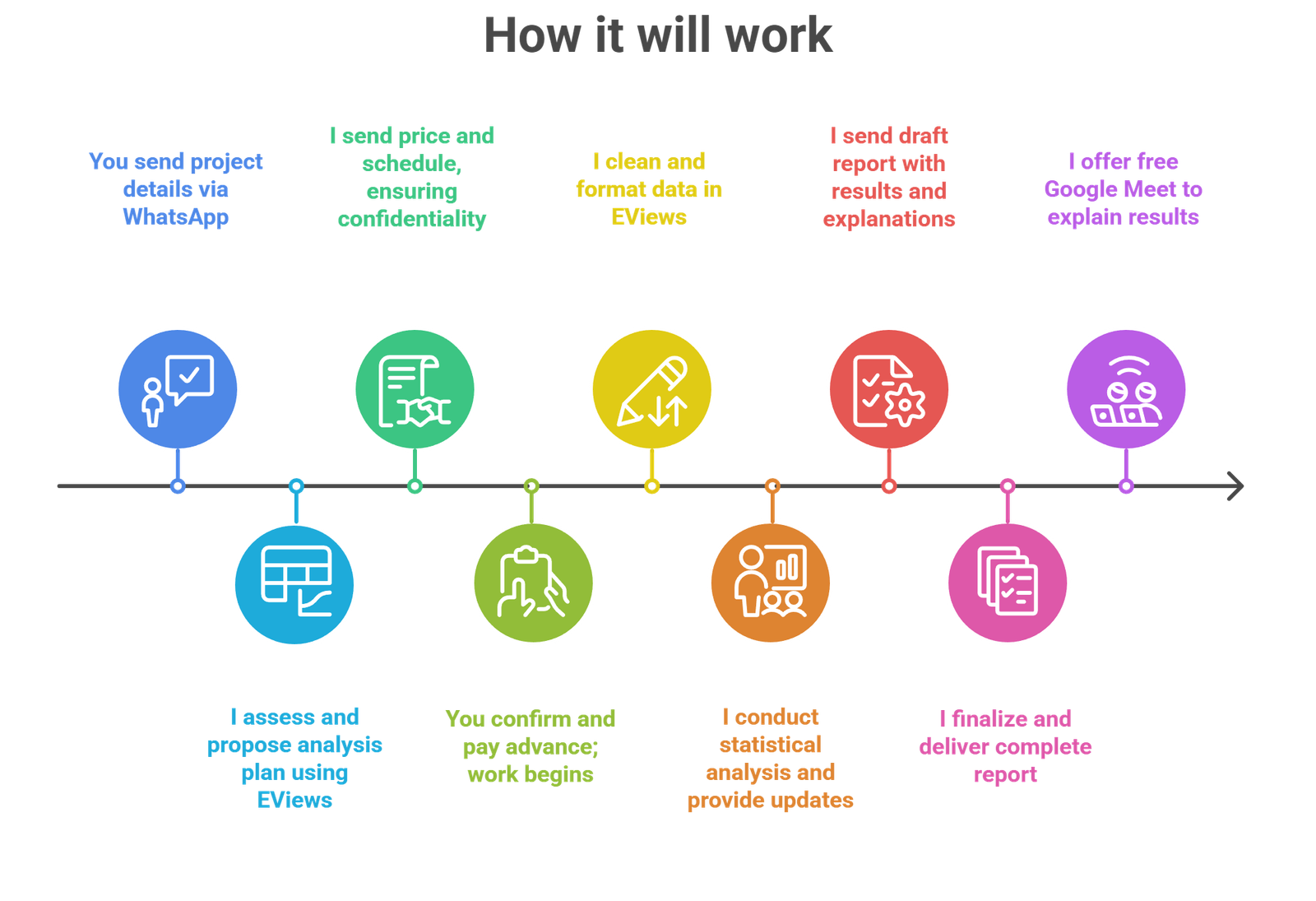

Process

Customer Reviews

5 reviews for this Gig ★★★★★ 4.6

service was good output was fine but i felt the report writing could be more academic sounding still helped a lot

got my forecasting assignment completed using ARIMA in eviews and he explained the whole logic behind the lag selection

he saved my thesis man i was stuck with eviews VAR and got the whole thing done in two days

was expecting a bit more graphs but otherwise the cointegration part and vecm explanation was very detailed and correct

helped me with panel data estimations and fixed all my model assumptions that i messed up totally worth it