I can help you conduct Multiple Linear Regression and Reporting using EViews

- 4.6

- (5)

Project Details

Why Hire Me?

With 7+ years of experience in econometrics and applied statistics, I provide accurate and reliable regression analysis using EViews, supported by clear interpretation and professional reporting.

-

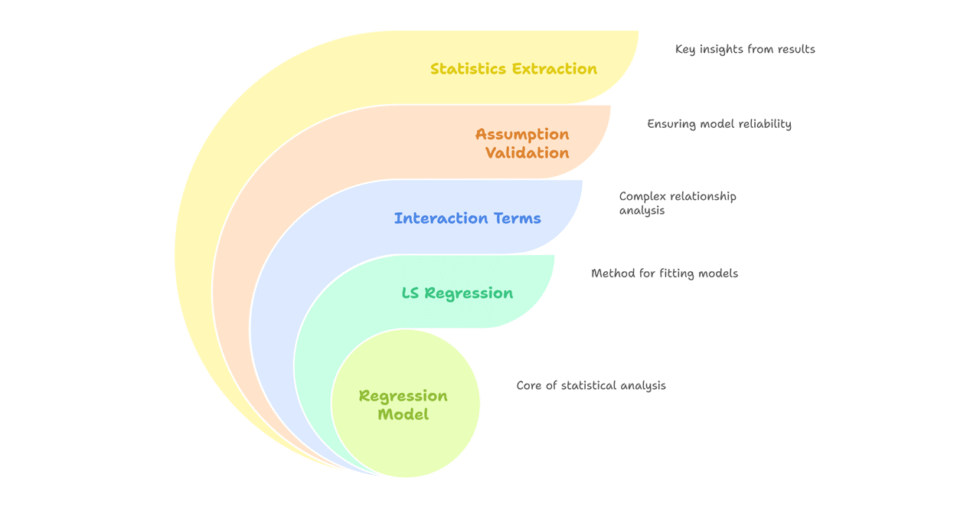

Skilled in modeling with quantitative, dummy, and interaction variables in EViews

-

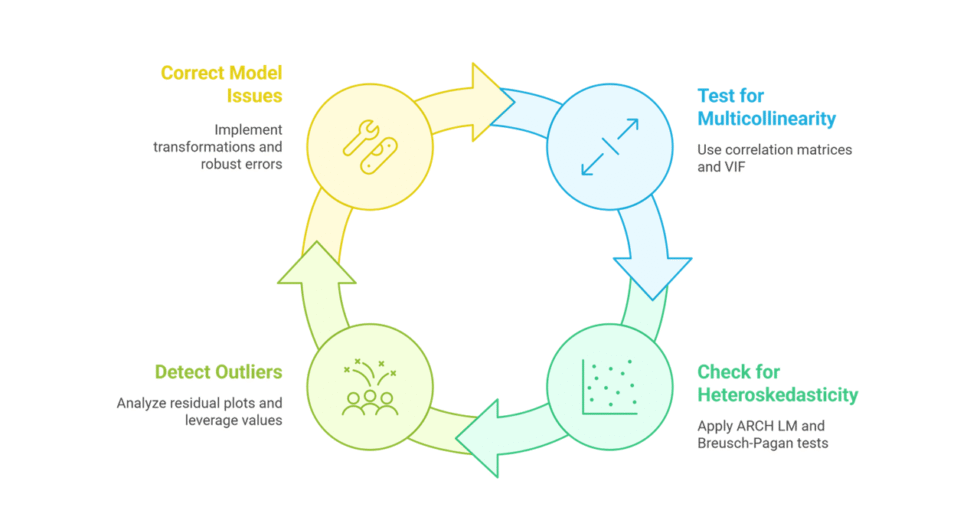

Proficient in regression diagnostics including multicollinearity checks, residual analysis, and assumption validation

-

Capable of forecasting and trend projection using EViews regression framework

-

Experienced in handling both cross-sectional and time-series datasets

-

Able to produce reports suited for academic publication, business strategy, or policy research

What I Need to Start Your Work

-

Project Details

-

Overview of your analysis objective and the role of regression in the project

-

Research questions or hypotheses that guide the regression model

-

-

Data and Data Description

-

Dataset in

.csv, Excel, or EViews workfile formats -

Explanation of variables (dependent and independent), and any transformations or cleaning already done

-

-

Exact Requirements

-

Specific variables to include in the regression model

-

Any customizations needed, such as dummy coding, interaction terms, or lag structures

-

Assumptions or constraints to test (e.g., multicollinearity, heteroskedasticity)

-

-

Reporting Expectations

-

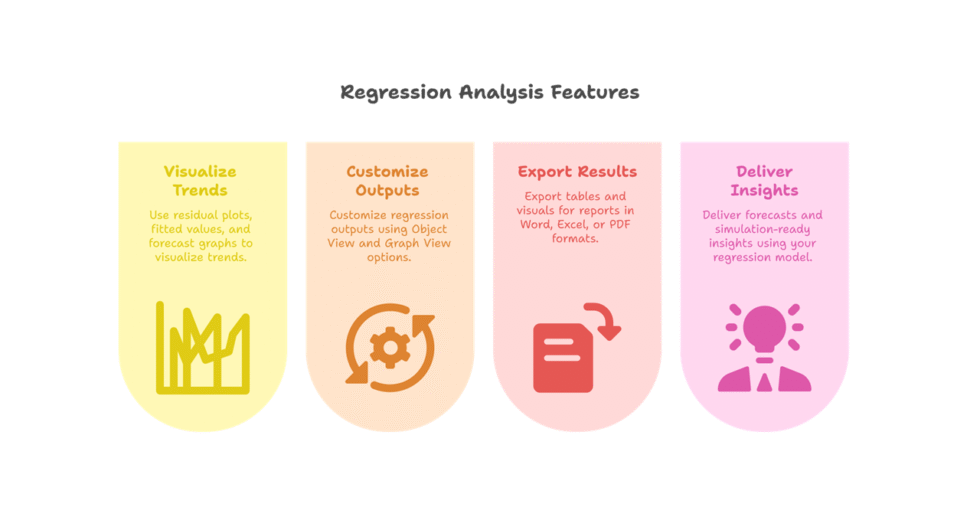

Final format (PDF report, Word document, annotated EViews output)

-

Requirements for statistical tables, coefficient interpretations, and visuals (e.g., residual plots, forecast graphs)

-

Formatting preferences for academic or professional style

-

-

Communication Preferences

-

Your preferred method of communication and update frequency

-

Key deadlines or delivery milestones

-

Portfolio

Modeled U.S. Wage Growth Determinants Using EViews Regression

Built a multiple regression model in EViews to analyze the impact of education, experience, and industry on wage growth in the U.S., supporting HR and policy analysis.

Explained London Property Price Variation with EViews Regression

Applied EViews to identify key predictors of residential property values in London using housing size, location, and interest rate data, aiding investor risk modeling.

Quantified ESG Influence on Stock Returns Using EViews MLR Model

Used EViews to evaluate the effect of ESG scores on stock returns across developed markets, helping institutional investors incorporate sustainability metrics into forecasting models.

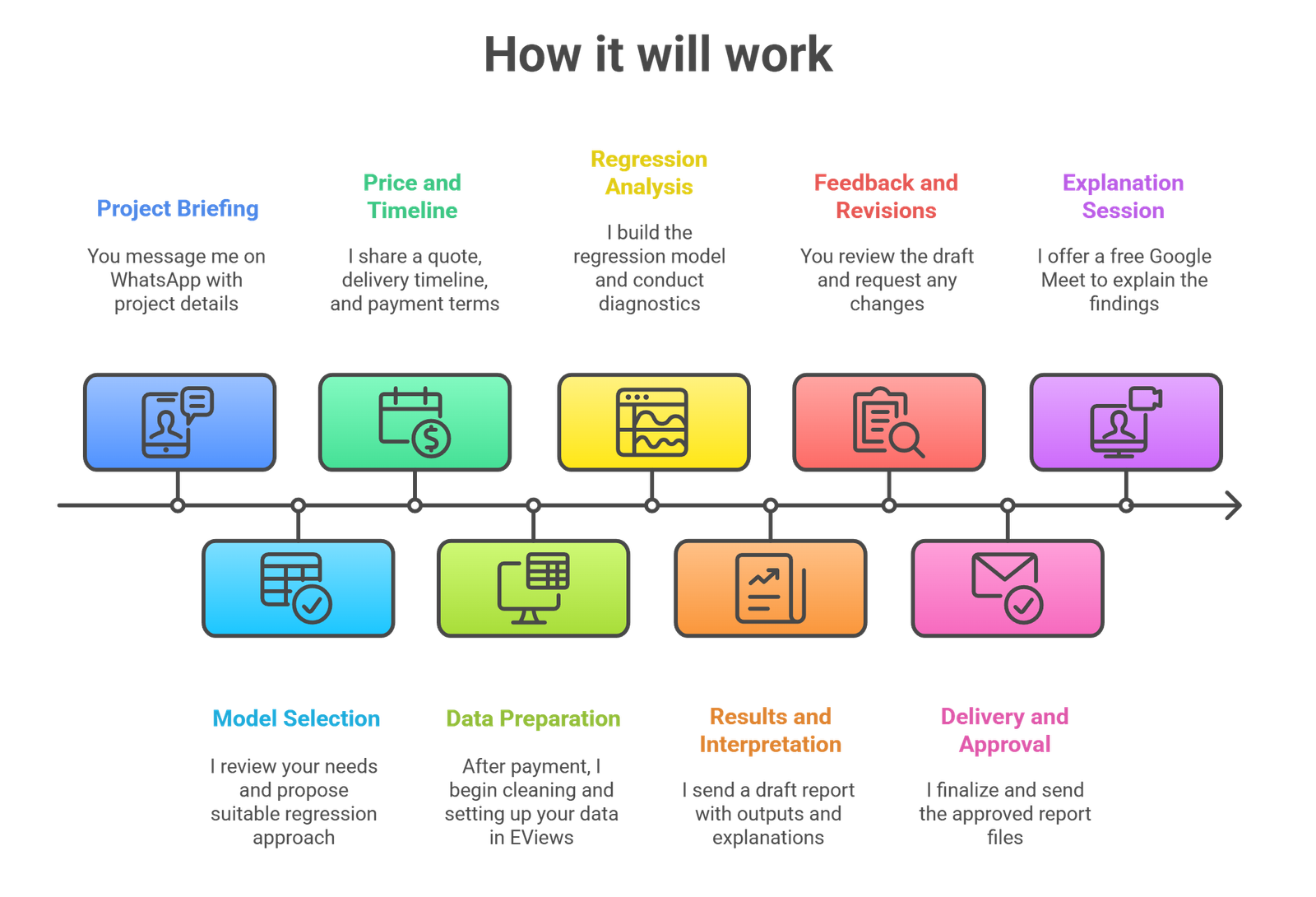

Process

Customer Reviews

5 reviews for this Gig ★★★★★ 4.6

i had no clue how to interpret my eviews regression but he explained it all step by step the final report was very well made

the forecasting part was really accurate and the graphs looked clean just that initial cleaning steps could’ve been explained better

he knew eviews inside out especially when it came to creating dummy variables and testing interactions made my project solid

model was good but i wish he had added more comments inside the eviews file otherwise very professional and fast

used eviews for my finance paper he did all diagnostics and explained heteroskedasticity so well i actually understood it this time