I can help you conduct econometric analysis using EViews and write report

- 4.7

- (5)

Project Details

Why Hire Me?

With over 7 years of experience as a data analyst, I bring deep expertise in using EViews for econometric analysis. My services cover everything from time-series forecasting and panel data models to rigorous diagnostics, with clear and concise reporting tailored for academic, business, or policy clients.

Key Strengths:

-

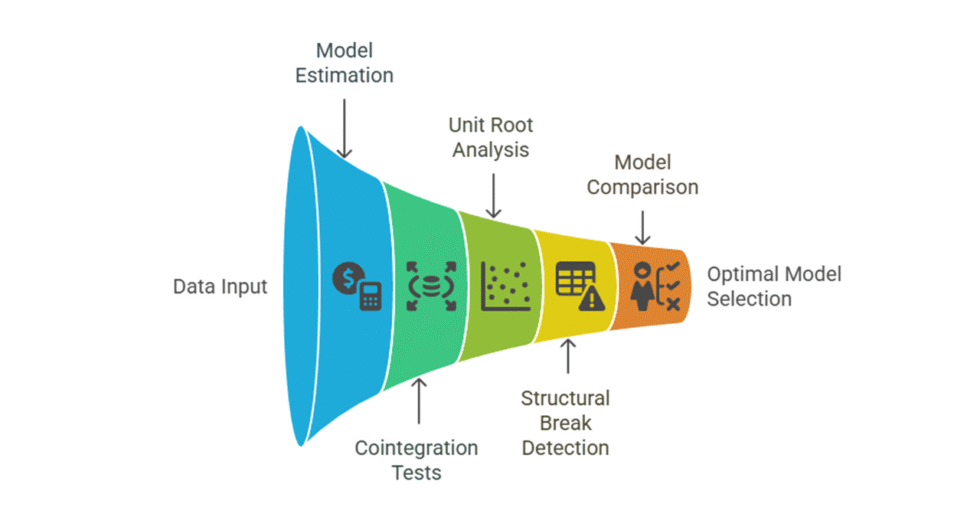

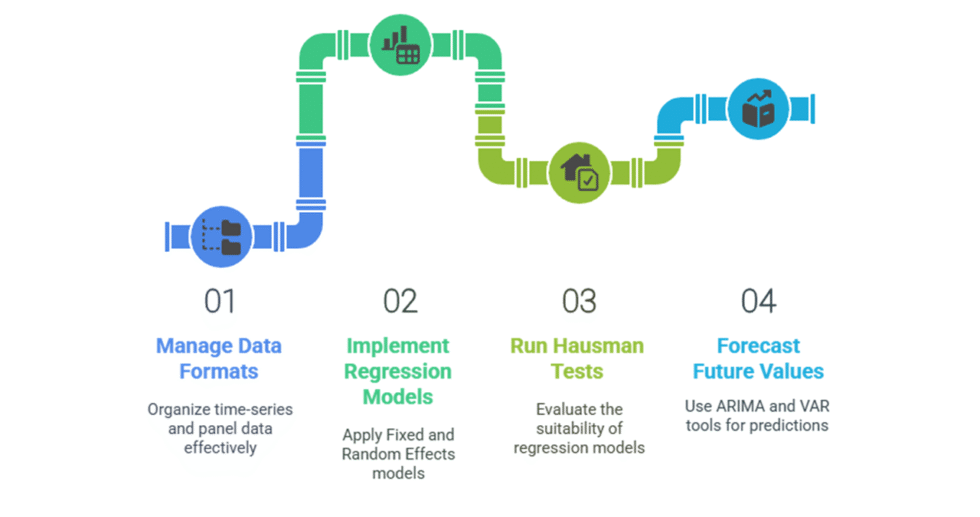

Skilled in ARIMA, GARCH, VAR, cointegration, and panel models using EViews

-

Robust model validation: residual analysis, unit root tests, heteroskedasticity checks

-

Clean data import, transformation, and model structuring using EViews’ GUI or command line

-

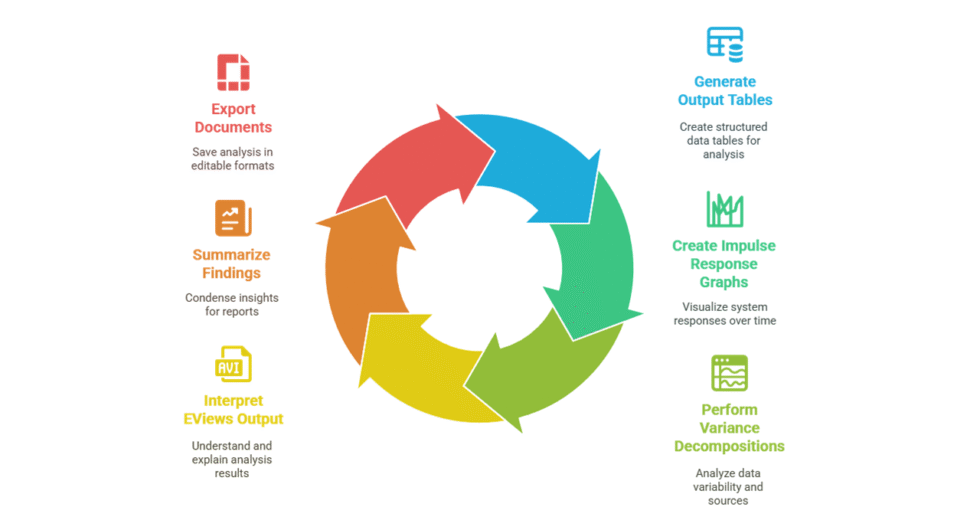

Reports formatted in APA/Harvard/IEEE style with EViews-generated tables and graphs

-

Ability to tailor model choice and report tone to specific industries and client needs

-

Confidential, deadline-bound service with optional walkthrough of methodology

What I Need to Start Your Work

To provide the most relevant and high-quality output, I will need the following:

-

Project Brief

-

Objective of your analysis (e.g., forecasting, hypothesis testing, sector study)

-

Research questions or hypotheses to be tested

-

-

Data Files & Details

-

Dataset in

.wf1,.csv, or.xlsxformat -

Variable names, frequency (daily/monthly/annual), units, and any preprocessing notes

-

-

Modeling Instructions

-

Preferred model types (e.g., ARIMA, GARCH, OLS, VECM, panel fixed/random)

-

Any assumptions or constraints to include in the model

-

-

Reporting Style & Depth

-

Required format and citation style

-

Level of statistical explanation needed (basic, moderate, technical)

-

If the report is part of academic coursework, business strategy, or policy research

-

-

Timeline & Communication

-

Deadline for first draft and final delivery

-

Your preferred method and frequency of updates (email, WhatsApp, Zoom)

-

Portfolio

Forecasted U.S. Unemployment Trends Using ARIMA-X in EViews

Built an ARIMA-X model in EViews to forecast U.S. unemployment rates using inflation and consumer confidence indices. The model supports labor market outlooks and strategic planning in public policy and HR analytics.

Evaluated Monetary Policy Effects on UK Output and Inflation with EViews VAR

Applied EViews Vector AutoRegression (VAR) to analyze how Bank of England policy rates influence inflation and GDP. Model insights guided macro strategy and interest rate risk assessments.

Identified EU Renewable Investment Drivers Using Panel Data Econometrics in EViews

Used EViews panel data regression to analyze how policy, economic, and environmental factors influence renewable energy investment across EU countries. Results supported ESG risk modeling and energy policy advisory.

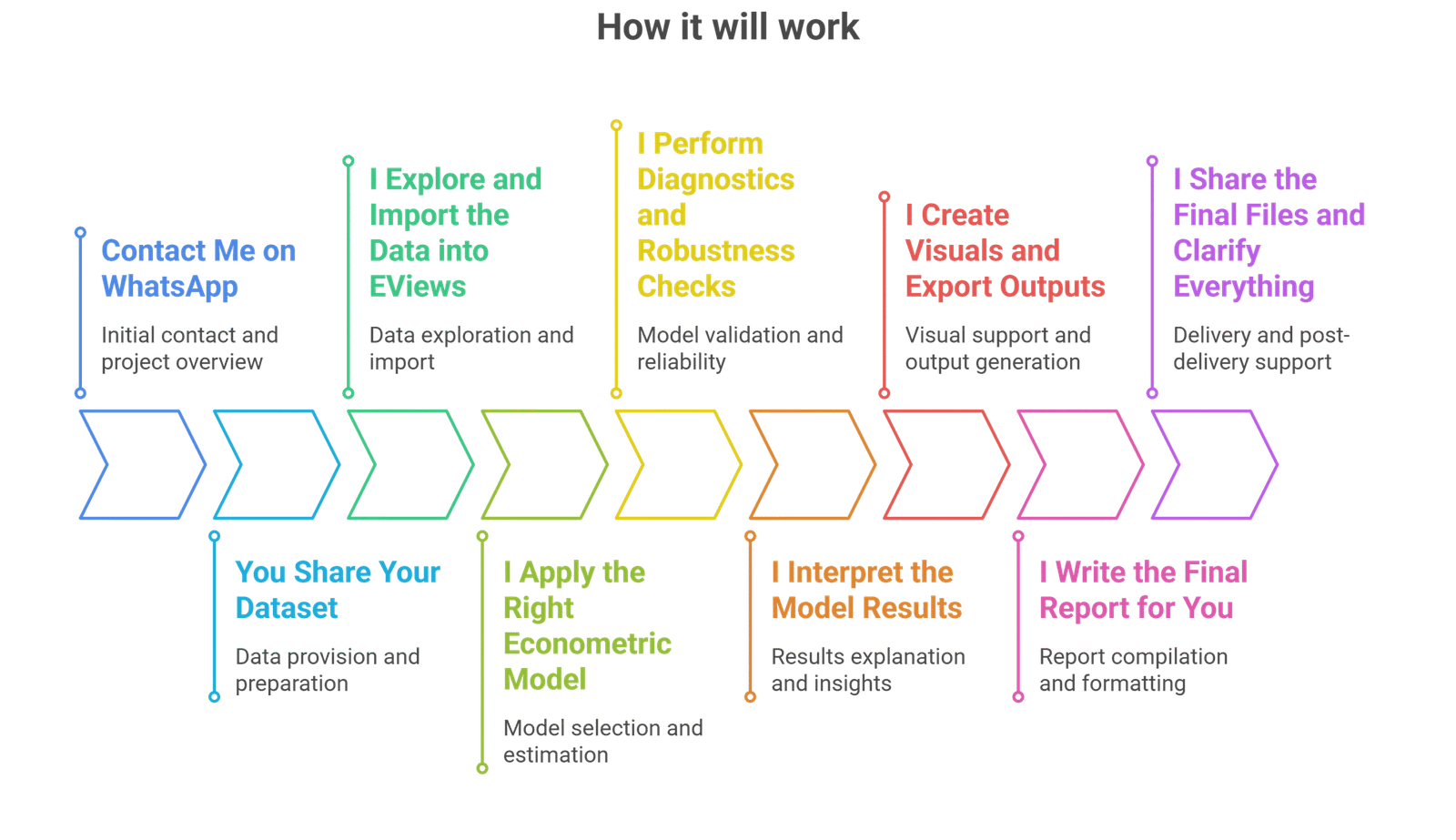

Process

Customer Reviews

5 reviews for this Gig ★★★★★ 4.7

good experience overall. he did unit root tests and showed how results change with different lags. visuals were basic but the analysis was solid

he cleaned up my csv file and converted it into EViews format. report was nicely structured with all steps explained. delivered before time

had to submit a macroeconomic model assignment and he used EViews to run it all. interpretation was simple to follow and references were all APA styled

he helped with forecasting using ARIMA and did all the diagnostics. formatting was neat but wish he added a small executive summary in the report

used EViews for cointegration and VAR model. he explained the results better than my professor did. graphs and tables looked clean in the report