I can help you conduct time series forecasting using EViews

- 3.9

- (5)

Project Details

Why Hire Me?

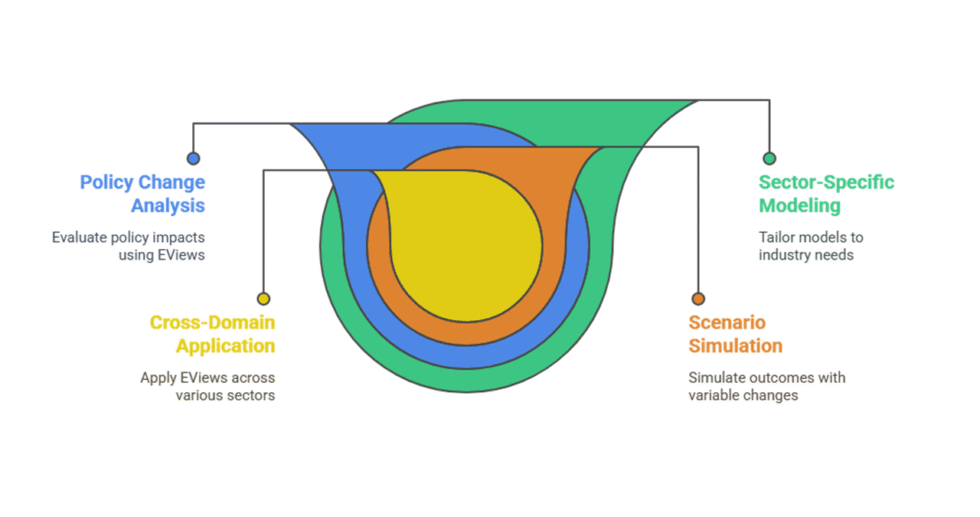

With over 7 years of hands-on experience in EViews, I specialize in building and validating time series forecasting models for economic, financial, and sector-specific datasets. I help transform raw data into actionable foresight.

Why Clients Choose Me:

-

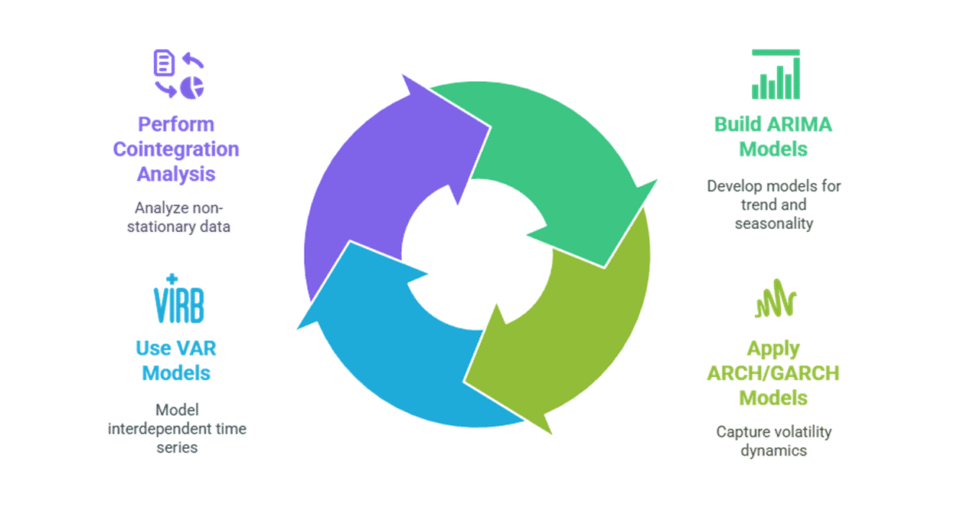

Expertise in ARIMA, ARCH/GARCH, VAR, and VECM modeling in EViews

-

Strong knowledge of seasonal adjustment, stationarity testing, and trend decomposition

-

Skilled in handling economic indicators, macroeconomic data, financial time series

-

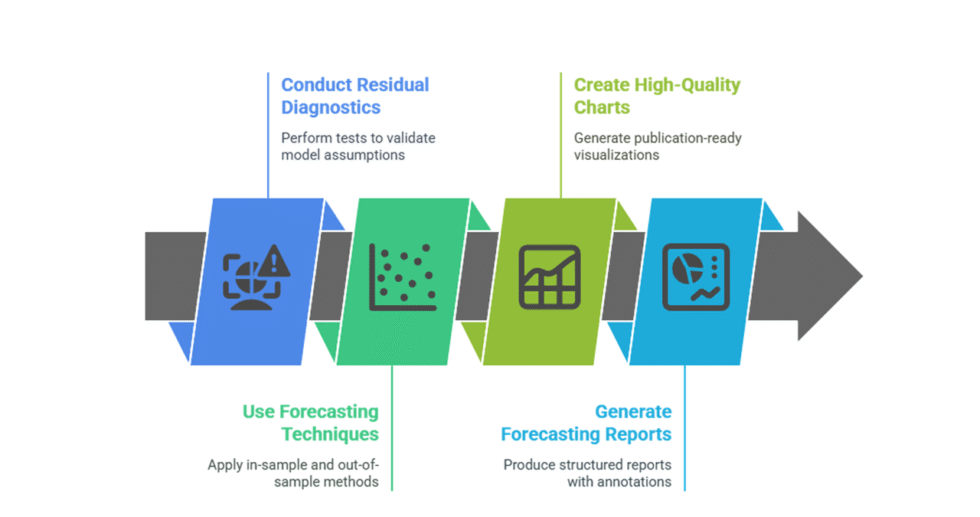

Capable of producing publication-ready reports with model diagnostics and forecasting insights

-

Experienced in cointegration analysis and impulse response functions for multivariate models

-

Flexible to adapt reports to academic, industry, or policy-making standards

What I Need to Start Your Work

To ensure high-quality delivery of EViews-based forecasting, please share the following:

1) Project Overview and Objectives

-

Clear goals for the forecasting exercise

-

Key questions or hypotheses (e.g., "Does GDP follow a seasonal pattern?", "Forecast inflation over the next 8 quarters")

2) Time Series Data Details

-

File format (Excel, CSV, EViews WF1)

-

Frequency of data (monthly, quarterly, annual)

-

Variables to be modeled

-

Notes on transformations (log, difference, deseasonalization)

3) EViews Forecasting Methodology

-

Preferred models: ARIMA, VAR, GARCH, etc.

-

Any pre-selected lag structure or modeling assumptions

-

Whether structural breaks or dummy variables need to be incorporated

4) Reporting Expectations

-

Preferred length and structure of the report

-

Whether you need detailed interpretation or only technical output

-

Graphs, tables, and executive summary requirements

-

Format (Word, PDF, or both)

5) Data Confidentiality & Ethics

-

Whether you require an NDA

-

Any legal or academic data privacy guidelines I should follow

6) Timeline & Delivery Schedule

-

Final delivery date

-

Any intermediate deadlines for feedback

-

Draft versions and review meetings (if needed)

7) Communication Preferences

-

Preferred platform (Zoom, WhatsApp, Email)

-

Frequency of status updates

-

Process for file sharing

8) Special Instructions

-

Specific formatting (APA/Harvard style for academic clients)

-

Sector focus or intended use of report (research, investor deck, etc.)

-

Benchmarks or reference projects (if applicable)

Portfolio

Forecasted U.S. Retail Sales Trends with ARIMA in EViews

Applied ARIMA modeling in EViews to forecast U.S. monthly retail sales. The model supported seasonal demand planning and sales risk assessment for retail and supply chain strategists.

Predicted Interest Rate Policy Shifts Using EViews Macroeconomic VAR

Built a Vector AutoRegression (VAR) model in EViews to forecast short-term interest rate changes using inflation, GDP growth, and unemployment data. Results supported treasury planning and monetary policy scenario analysis.

Forecasted German Electricity Prices Using EViews GARCH Time Series Model

Applied a GARCH model in EViews to forecast short-term electricity price volatility in Germany. The analysis enabled energy firms and market analysts to anticipate price risks and plan hedging strategies.

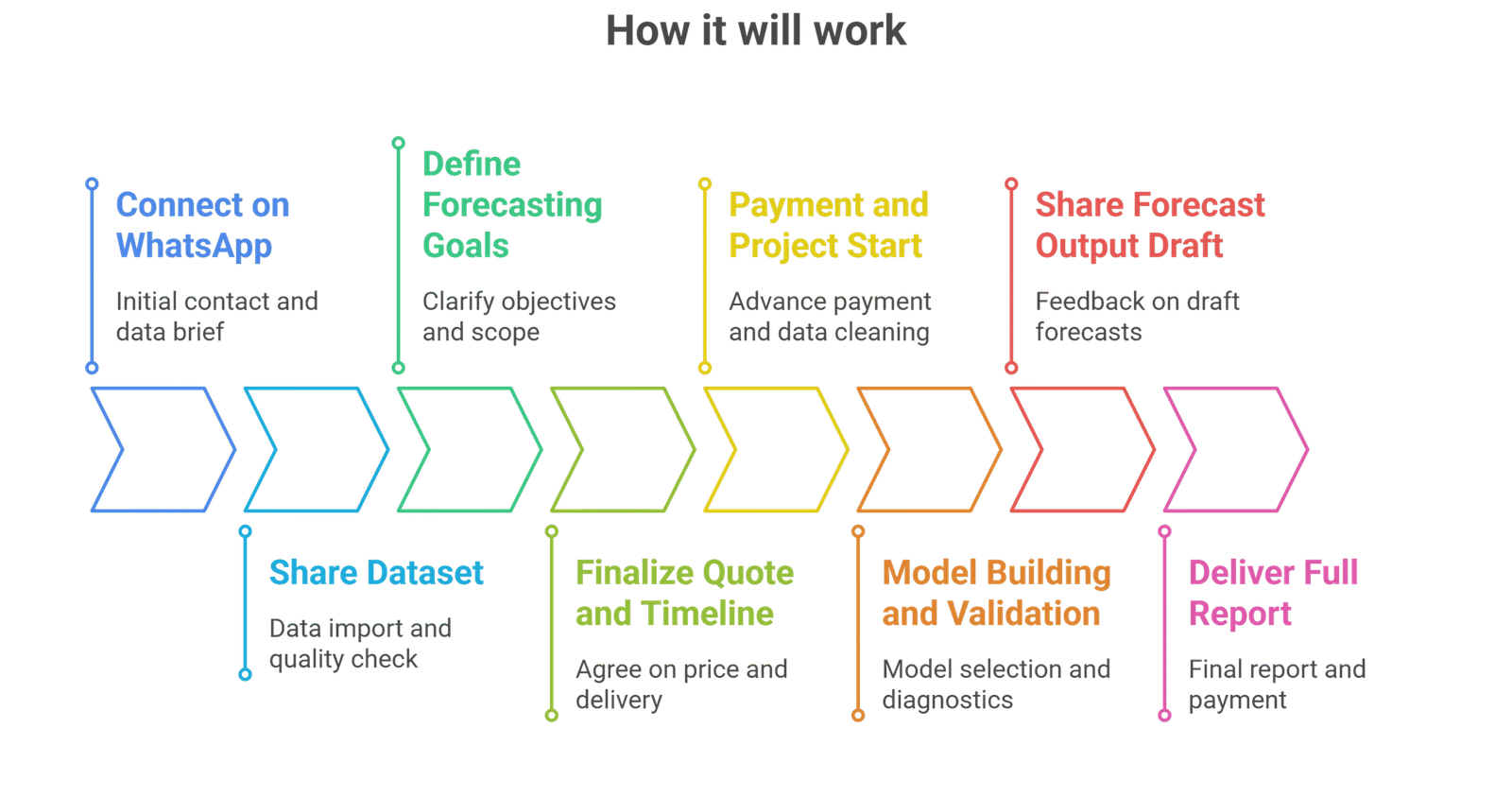

Process

Customer Reviews

5 reviews for this Gig ★★★★☆ 3.9

he handled my financial time series very well the interpretation of GARCH model was spot on would book again

project delivery was on time and the ARIMA modeling was strong though he should have included more scenario testing

very professional with clear step by step outputs he even helped me understand cointegration which i never got before

i liked the forecast part but the graphs were bit basic i had to rework some visuals for my presentation

he used VAR model to forecast GDP and explained things in a simple way helped me a lot with my research paper